It was reported on April 19th that just now, the domestic digital-analog hybrid chip design company landed in science and technology innovation board, and its main business is power management and fast charging protocol chips, with an issue price of 24.23 yuan/share.

After the opening, the opening price of Yingjixin was 24.23 yuan/share, and then the share price fell, with the biggest drop of 9.5%. As of the date of writing, its share price is 22.31 yuan/share, down 7.92%, with a total market value of 9.3 billion yuan.

Founded in 2014, Yingjixin is currently one of the major chip suppliers in other application fields.

There are about 230 models of products generated by Yingjixin, which are used in mobile power supply, fast charging power adapter, wireless charger, car charger, TWS earphone charging bin and other products. From 2018 to the first half of 2021, its chip sales reached 1.728 billion, and the final brand customers included Xiaomi, OPPO and other manufacturers.

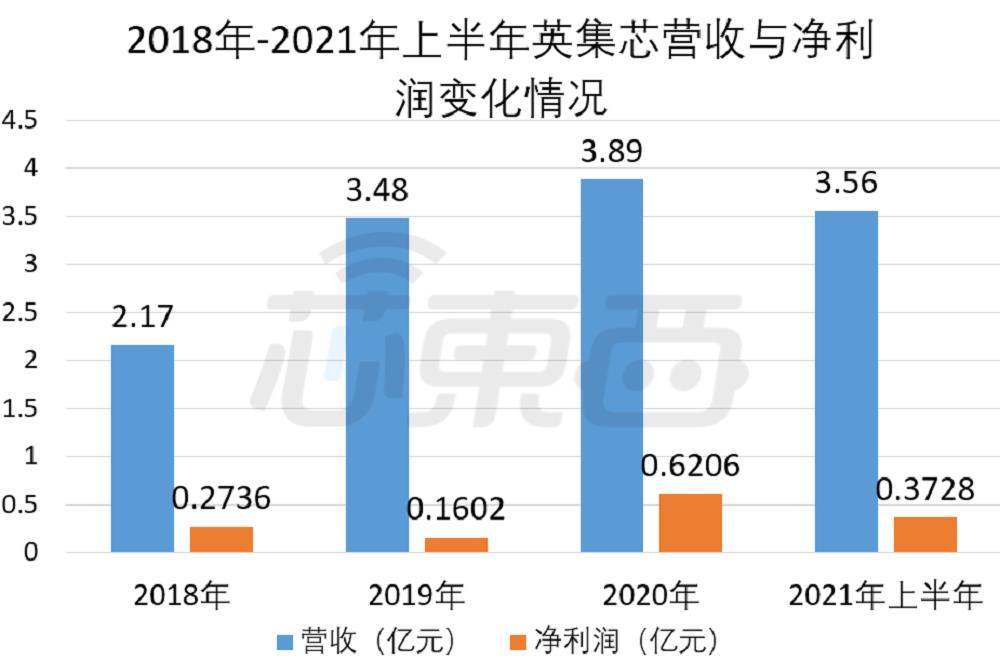

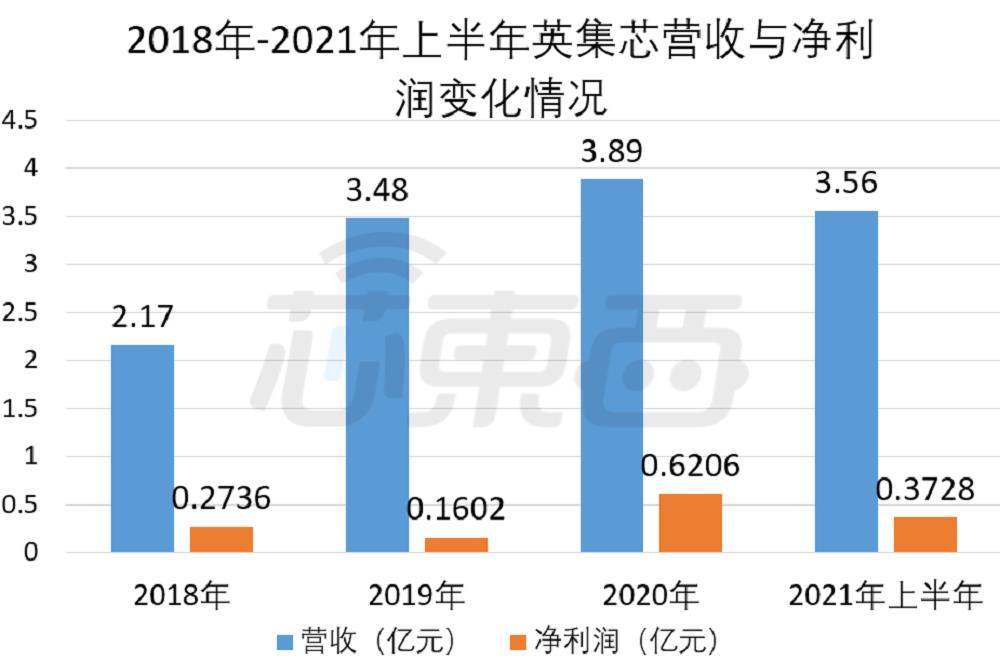

During the reporting period, the revenue of CIMC showed an increasing trend. The revenue of each period in 2018, 2019, 2020 and the first half of 2021 was.

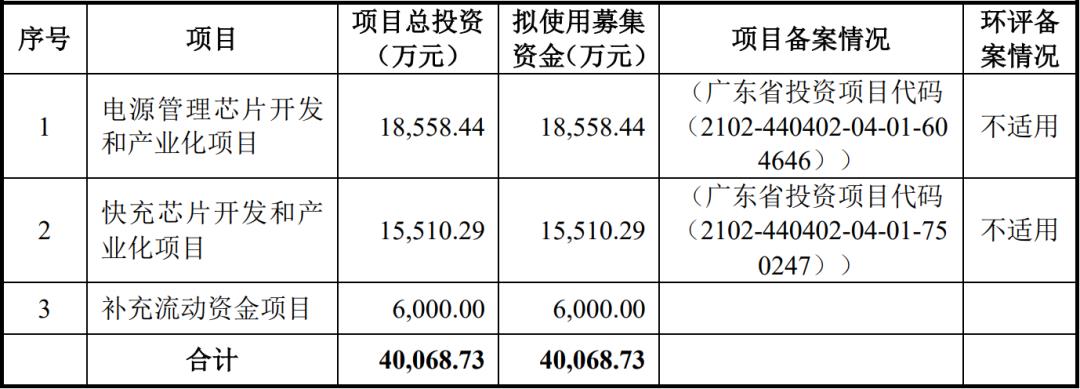

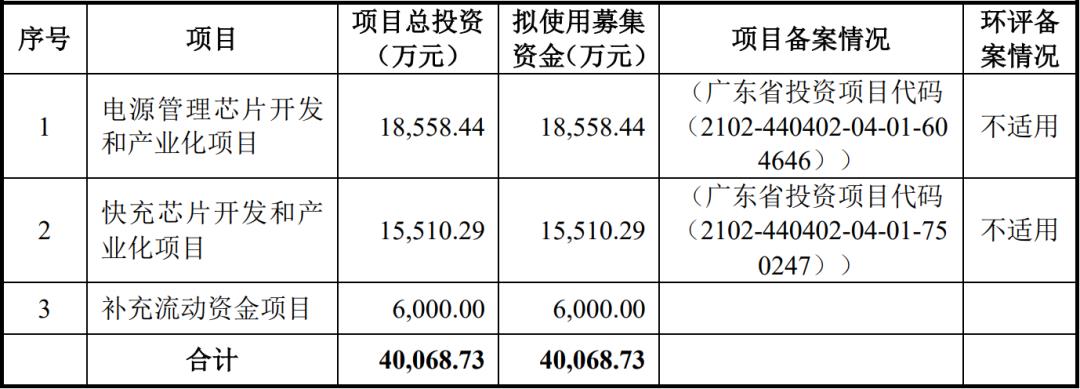

Yingjixin has no controlling shareholder, and the actual controller is Huang Hongwei, chairman and general manager of Yingjixin. In this IPO, CIMC plans to raise 400 million yuan, which will be used for three projects: development and industrialization of power management chips, development and industrialization of fast charging chips and supplementary liquidity.

▲ Fund-raising of Yingji Core Program

Yingjixin was established on November 14th, 2014, when its shareholder was Qiu Fangfang. According to the prospectus, Qiu Fangfang was the spouse of Zeng Lingyu, a member of the founding team.

As the founding team is starting a business for the first time and there are many uncertainties, Qiu Fangfang is jointly selected as the nominal shareholder, and the trustees include 16 people including Huang Hongwei, Ding Jiaping and Zeng Lingyu.

▲ Huang Hongwei, Chairman and General Manager of Yingjixin

It is worth noting that. Among them, LING HUI worked as general manager, general manager and senior vice president of the Internet of Things Division in China Resources Siwei Technology (Shanghai) Co., Ltd., Guangzhou Anbao Electronics Co., Ltd. and Shenzhen Bettler Electronic Technology Co., Ltd., and joined Yingjixin as technical director in July 2020.

Among the other four people, Huang Hongwei, Chairman and General Manager of Yingjixin, Dai Jialiang, Director of System R&D Department, Zeng Lingyu, Deputy Director of IC R&D Department, and Tang Xiao, Deputy Director of IC R&D Department, all worked together in Xinhengfu Technology, a subsidiary of Juli Integration and Fuman Electronics.

In 2013, 10 people, including Huang Hongwei, left Torch Power Integration and planned to start a business in the field of power management chips, but they lacked financial support. Fuman Electronics plans to enter the power management chip market through its Xinhengfu technology. So the two sides jointly created Xin Yiman, and Huang Hongwei and others joined Xinhengfu Technology.

After the establishment of Xinyi Man, the cooperation was finally terminated in October 2014, and the company was cancelled in June 2016.

However, this cooperation has also brought about a long-term lawsuit between Fuman Electronics and CIMC. Fuman Electronics, its subsidiaries Xinhengfu Technology and Liu Wenjun initiated six lawsuits against Yingjinxin, and there were disputes over intellectual property rights and technology patents with Yingjinxin.

According to a source quoted by Jiwei.com, in the fourth quarter of 2018, Fuman Electronics was optimistic about the advantages of Yingjixin in the charging treasure and wireless charging market, and planned to acquire Yingjixin. However, after the negotiations failed, Fuman Electronics began to dig people. The earliest lawsuit of Fuman Electronics against Yingjixin also began in November 2018.

At present, among the six lawsuits filed by Yingjixin, Fuman Electronics and Liu Wenjun, five lawsuits have reached a settlement, and the plaintiff has withdrawn the lawsuit and closed the case. The administrative lawsuit of Fuman was decided by Beijing Intellectual Property Court in January, 2022, which rejected the plaintiff’s claim of Fuman Electronic Litigation, and Fuman Electronic refused to accept it and filed an appeal. The case is still being accepted by the Supreme People’s Court.

During the reporting period, the revenue of CIMC showed an increasing trend, with revenue of 217 million yuan, 348 million yuan, 389 million yuan and 356 million yuan in the first half of 2018 -2021 respectively, with a compound growth rate of 34.04% from 2018 to 2020.

In terms of profit, the net profit of Yingjixin in the first half of 2018 -2021 is.

▲ Changes in revenue and net profit of CIMC in the first half of 2018 -2021.

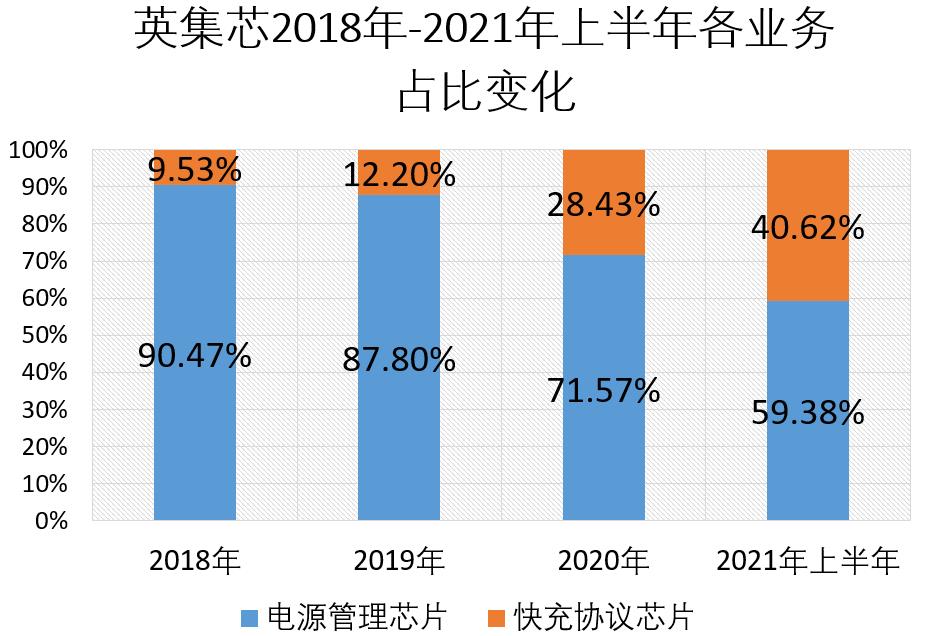

The main source of revenue for CIMC is that from 2018 to 2020, the revenue of CIMC power management chips will increase from 194 million yuan to 268 million yuan.

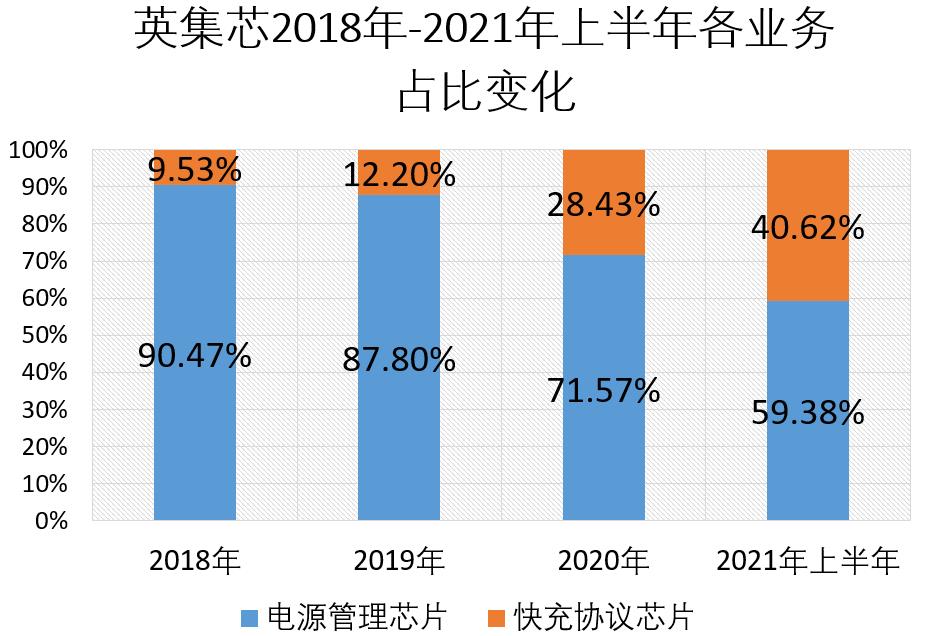

However, with the growth of its fast charging protocol chip revenue, its power management chip revenue ratio has dropped from more than 90% in 2018 to 59.38% in the first half of 2021.

▲ Proportion of various businesses of CIMC in the first half of 2018 -2021.

From 2018 to the first half of 2021, the R&D expenses of Yingjinxin were 33.2275 million yuan, 44.2605 million yuan, 50.65 million yuan and 38.7085 million yuan, respectively, accounting for 15.34%, 12.72%, 13.01% and 10.88% of the operating income in the same period.

By the end of June, 2021, CIMC had a total of 61.48% employees. It has obtained 79 domestic patents, including 49 invention patents and 30 utility models. Yingjixin also owns 115 registration certificates of integrated circuit layout design and 11 computer software copyrights.

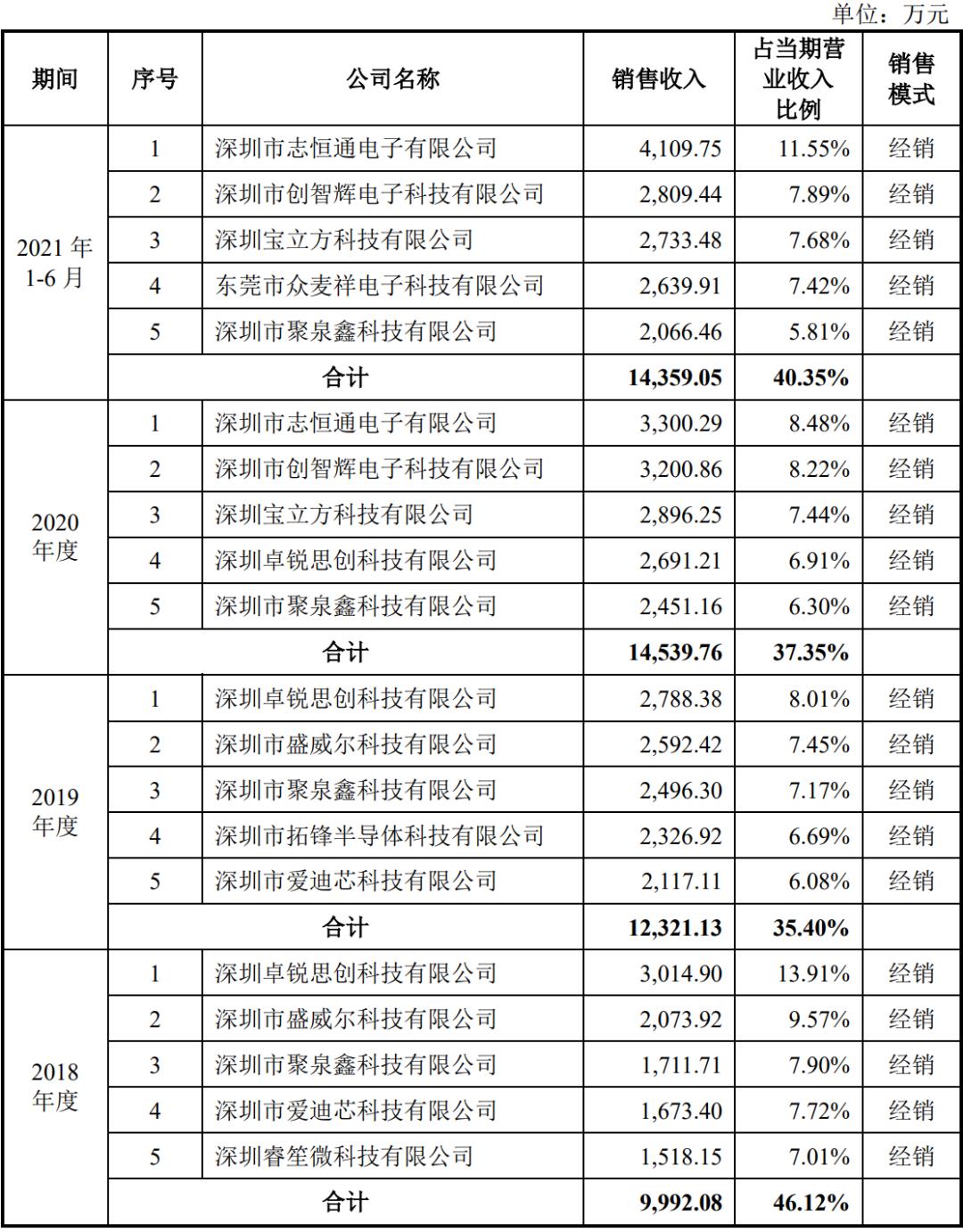

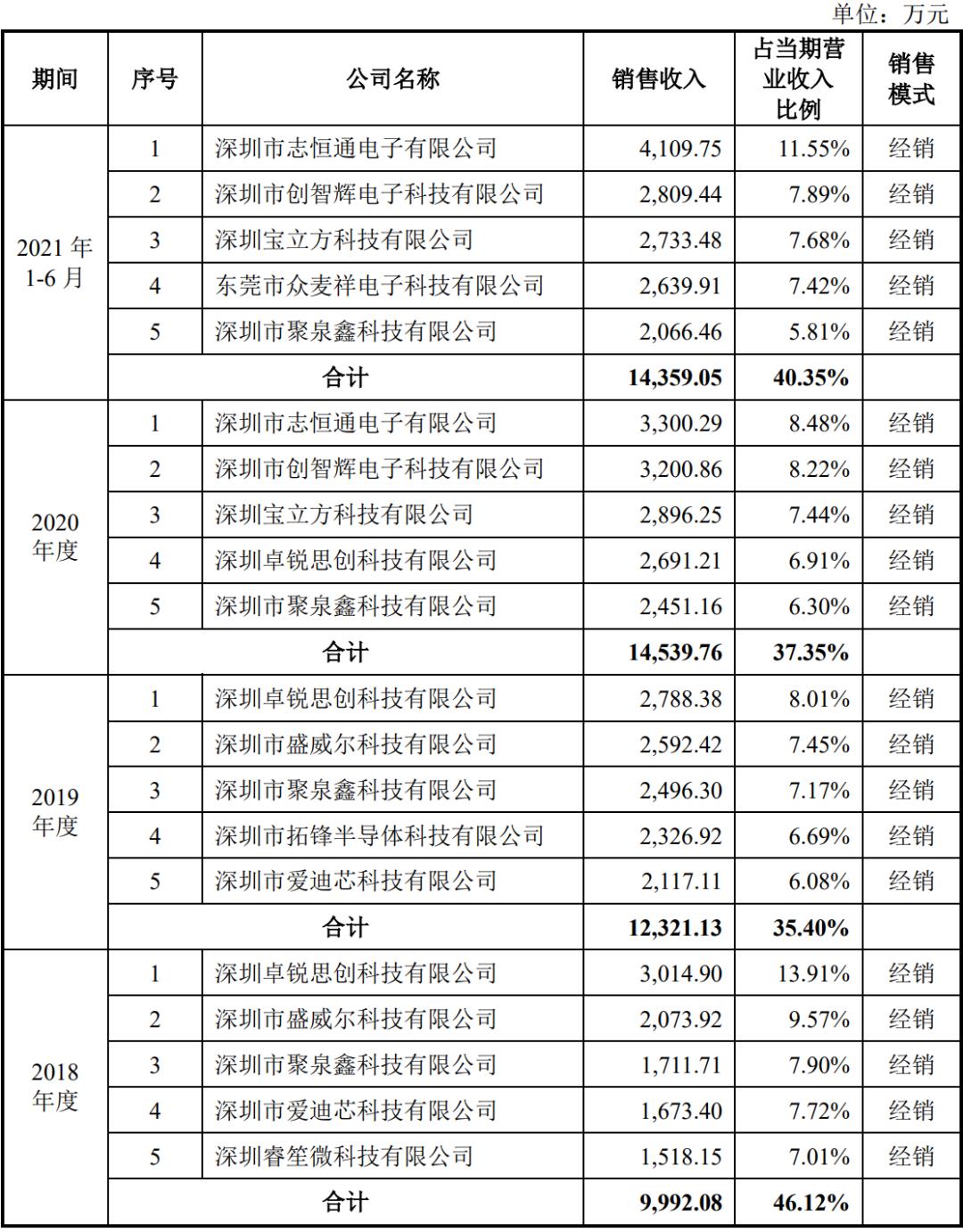

During the reporting period, the main customers of Yingjixin were basically stable, and most of them were dealers, including Shenzhen Zhihengtong Electronics Co., Ltd. and Shenzhen Zhuorui Sitron Technology Co., Ltd.. Through distributors, its ultimate brand customers are.

▲ Top five customers of CIMC in the first half of 2018 -2021

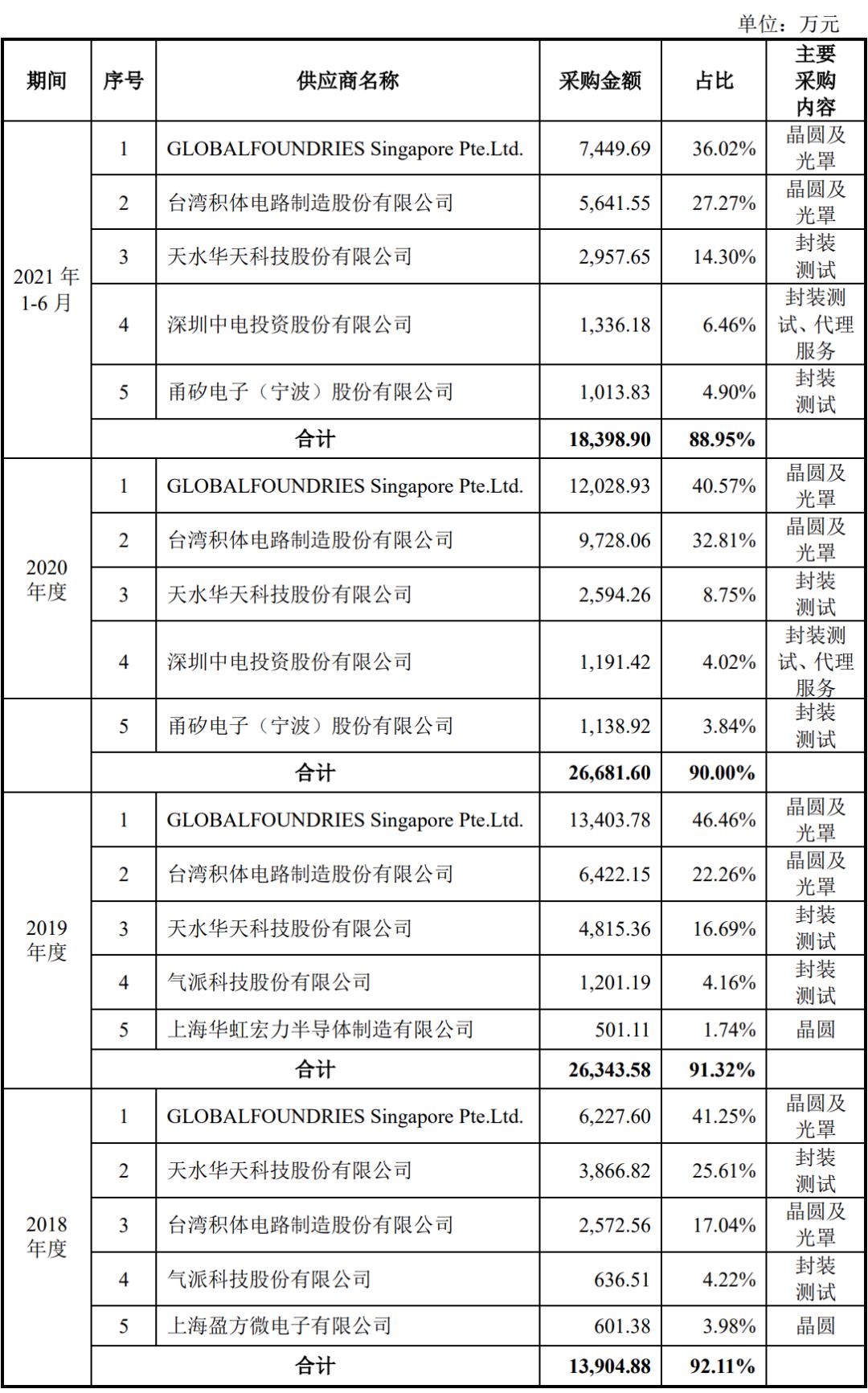

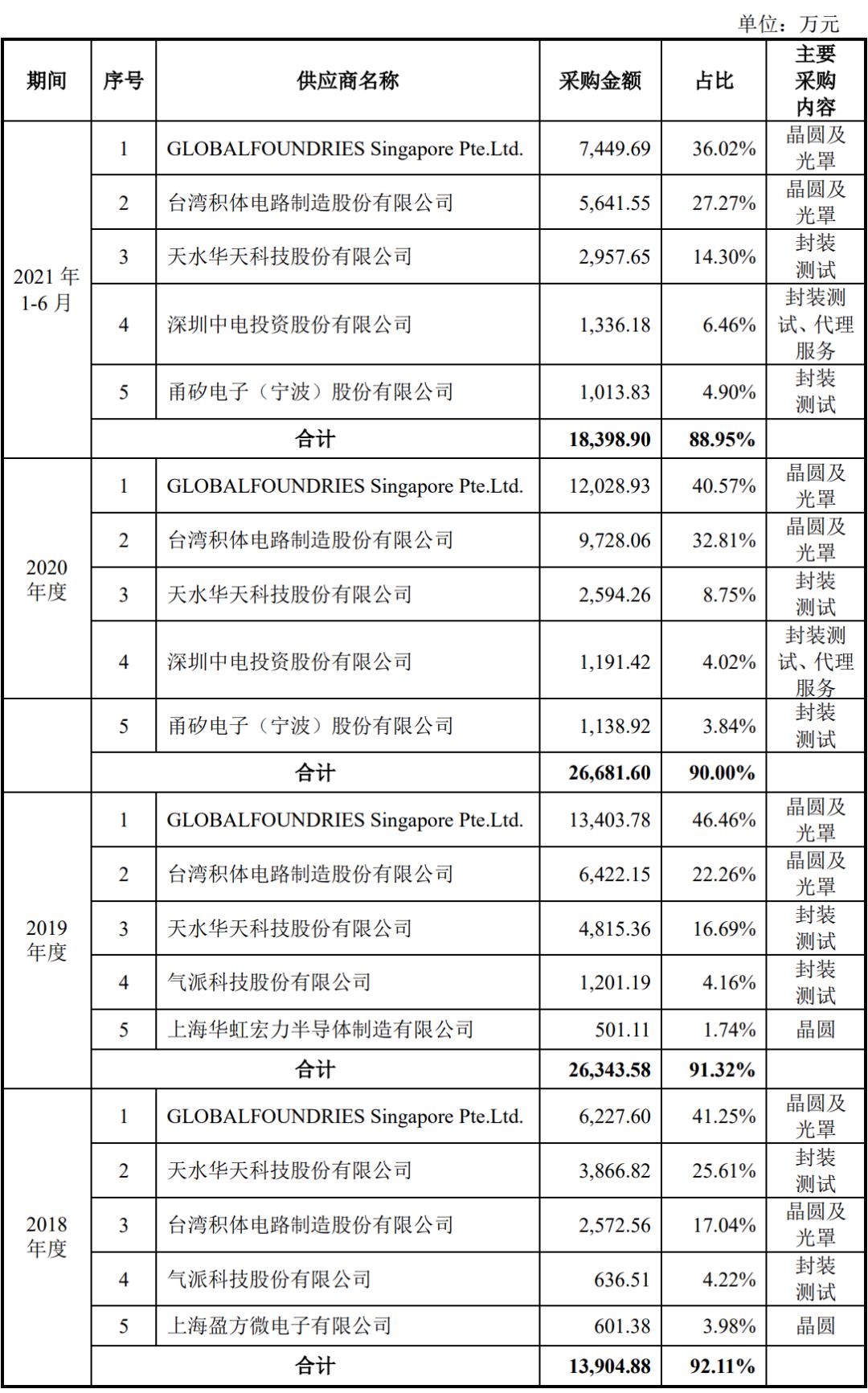

As a chip design company, the main procurement projects of CIMC include. According to the prospectus, the main wafer supplier of Yingjixin is, and the main supplier of packaging and testing services is Tianshui Huatian Technology.

▲ The top five suppliers of Yingjixin

From the perspective of the whole industry, the global power management chip market is highly concentrated, and its market share is mainly occupied by international enterprises such as Texas Instruments, Infineon, Power Integrations and MPS.

At present, China power management chip companies such as Shengbang, Xinpengwei and Jingfeng Mingyuan have successfully landed in the capital market and gradually have a certain scale of operation. However, domestic manufacturers have a certain gap with international head manufacturers in market share and technical strength.

▲ Market share of Yingjixin and comparable domestic companies in the same industry in power management chips.

According to the prospectus, there is a gap between Yingjixin and overseas famous brands in terms of business scale and overall technical strength. However, in the product field in which it focuses, the performance index of Yingjinxin products is similar to that of Texas Instruments, PI, Infineon and other corresponding products, and it reaches or even exceeds the products of overseas companies in the same industry in terms of integration, compatibility and the number of supporting agreements.

The power management chip of CIMC is mainly that this scheme adopts a single mixed digital-analog SoC chip, which can replace the functions that traditional digital and analog chips can achieve with a mixed digital-analog SoC chip.

Through this mixed digital-analog SoC integration technology, CIMC can integrate digital chips, analog chips, systems and embedded software into one SoC chip, shortening the development cycle of customers’ finished products and reducing production costs.

In terms of fast charging protocol chips, the products of Yingjixin have been authorized by mainstream platforms such as Qualcomm, MediaTek, Spreadtrum, Huawei, Samsung, OPPO, Xiaomi and vivo. Its products not only support all five kinds of fast charging protocols of domestic communication terminals,

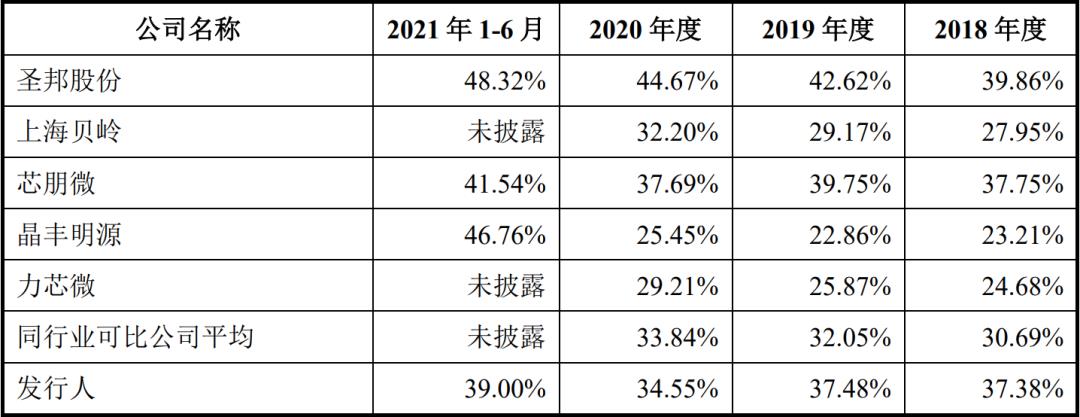

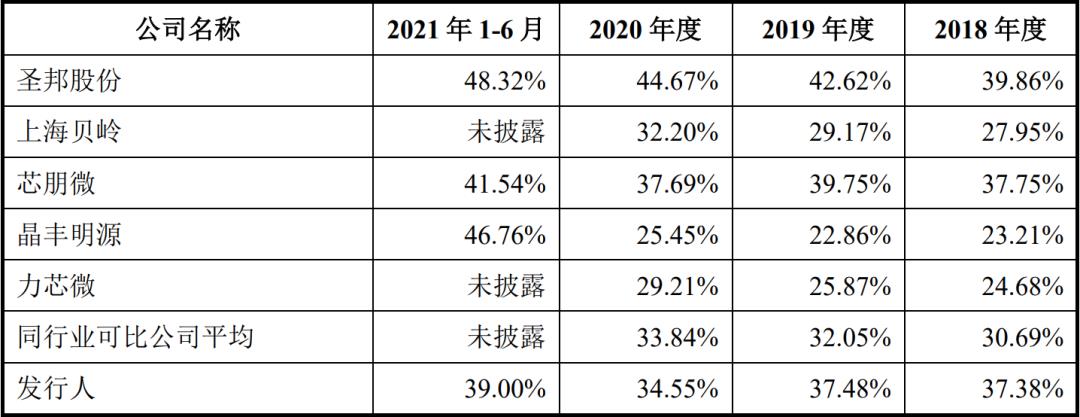

Compared with domestic comparable companies in the same industry, the gross profit margin of Yingjixin is low, which is mainly related to the differences in product structure, functional positioning and application fields, according to the prospectus. Compared with the power management chips of comparable domestic companies in the same industry, the gross profit margin of power management chips of Yingjixin is in the middle-upper level.

▲ Gross profit margin of power management chips of Yingjinxin and comparable companies in the same industry from 2018 to the first half of 2021.

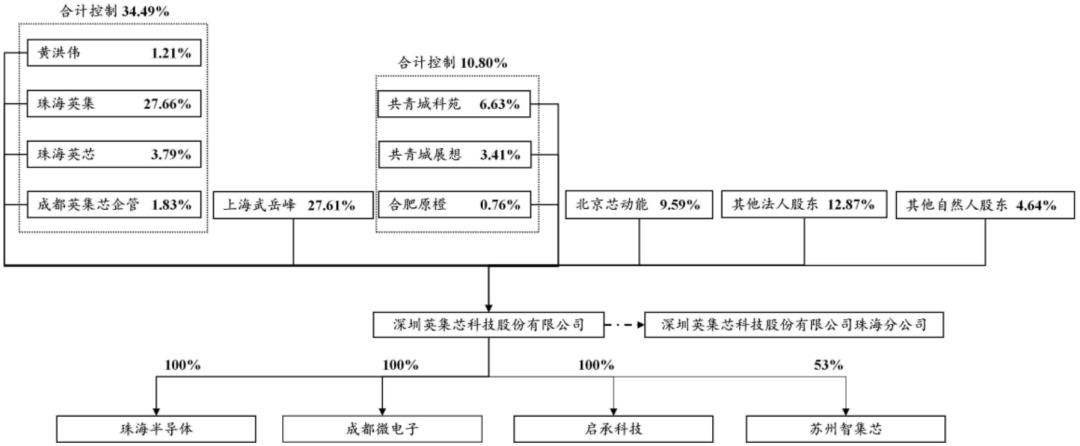

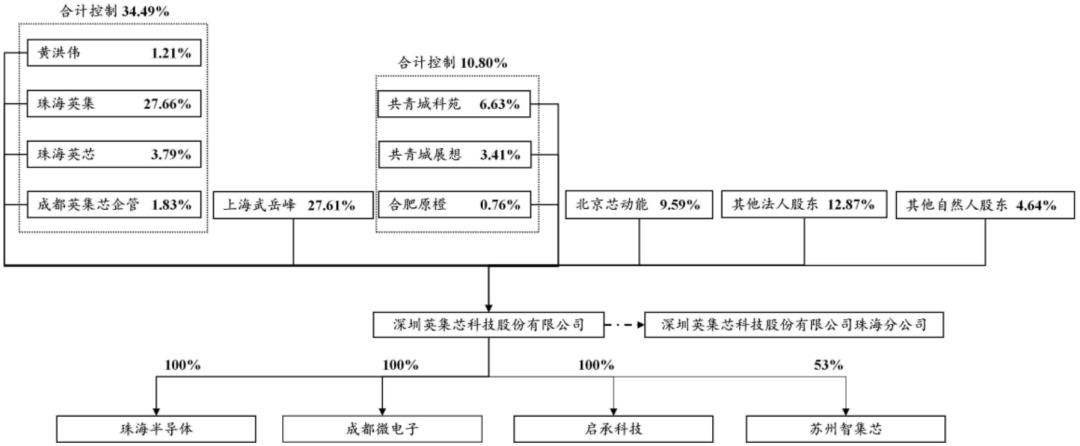

Due to the scattered equity, Huang Hongwei, its chairman and general manager, directly holds 1.21% of the shares of Yingjixin, and indirectly controls 33.28% of the shares through three employee stock ownership platforms: Zhuhai Yingji, Zhuhai Yingxin and Chengdu Yingjixin Enterprise Management, and controls a total of 34.39% of the shares.

▲ Equity structure of Yingjixin

Shareholders who own more than 5% of the shares of Yingjixin include Shanghai Wuyuefeng, Beijing Core Kinetic Energy and Gongqingcheng Keyuan, with 27.61%, 9.59% and 6.63% of the shares respectively.

In addition, funds such as Shanghai Science Venture Capital and Suzhou Juyuan Casting Core also hold some shares of Yingjixin.

▲ Share capital of Yingji Core

The power management chip is a chip that is responsible for the transformation, distribution, detection and other control functions of the required electric energy in the electronic equipment system. It is the power supply center and link of all electronic products and equipment, and is an indispensable chip product in the fields of consumer electronics, automotive electronics and new energy.

At present, international leaders such as Texas Instruments and Infineon still dominate the power management chip market. At the same time of domestic chip substitution, domestic power management chip enterprises should carry out technological innovation to win domestic and even foreign market share. As a new domestic power management chip enterprise, Yingjixin’s products adopt mixed digital and analog chips which are different from the traditional ones, and its listing may help to increase the market share of domestic power management chips.

At present, with the rapid expansion of the power management chip market, many new chip companies have been founded or entered this field. If we can’t grasp the development trend and market dynamics of the industry, there are certain operational risks.