[Market Analysis] Palm Oil, Stock Index and Gold Variety Daily

Palm oil: As of the close of November 13th, the main contract of palm oil 2501 futures closed at 9782 yuan/ton, down 456 yuan/ton from the previous trading day, or 4.45%; The turnover increased to 1,615,800 lots, holding 486,800 lots.

Stock index: the domestic economic recovery is accelerated, the risk of deflation is eased, and the infrastructure is improved, but the real estate remains to be seen.

Gold: The US dollar index remained strong and gold continued to be under pressure.

palm oil

Date of Report | November 14th, 2024

I. Review of Futures and Spot Markets

As of the close of November 13th, the main contract of palm oil 2501 futures closed at 9782 yuan/ton, down 456 yuan/ton from the previous trading day, or 4.45%. The turnover increased to 1,615,800 lots, holding 486,800 lots.

In terms of positions, the total monthly contract positions of the top 20 futures companies were 426,000 long positions, 399,600 short positions and 26,400 net positions, a decrease of 0.75 million from the previous day.

Daily k-line trend of palm oil 2501 contract

Image source: Master Boyi

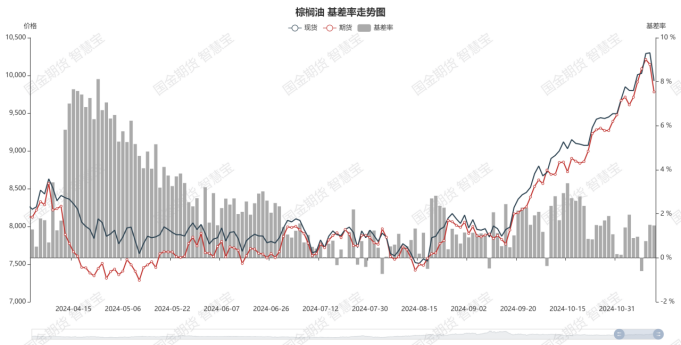

In terms of spot, as of November 13th, Guangzhou 24-degree edible refined palm oil was quoted at 9930 yuan per ton, Zhangjiagang at 9990 yuan per ton, Tianjin at 10070 yuan per ton, Rizhao at 10070 yuan per ton, Ningbo at 9990 yuan per ton and Fujian at 9930 yuan per ton. Spot average price and futures P2501 basis difference +146 yuan/ton.

Source: (), Guojin Futures Tiantian Research Institute.

Trend of palm oil basis and basis rate

Image source: Guojin Futures Wisdom Bao

II. Summary of Important News and Data

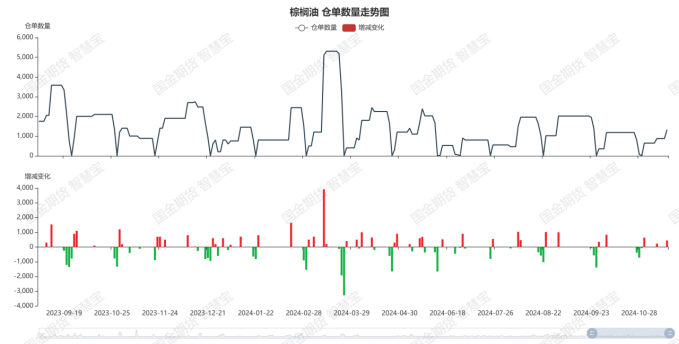

According to the warehouse receipt data of Dashang Institute on November 13th, 640 lots were recorded in Guangzhou Yihai and 300 lots to 534 lots were added in Tianjin Kerry. Jianghai grain and oil added 145 lots to 145 lots. A total of 445 lots were added to 1319 lots.

Palm oil warehouse receipt

Image source: Guojin Futures Wisdom Bao

On November 13th, the futures price difference between palm oil and soybean oil was 1,490 yuan/ton (9,782 yuan per ton for palm oil and 8,292 yuan per ton for soybean oil), reaching 1,666 yuan/ton in intraday trading.

According to the statistical data in recent 10 years, the latest average price difference of palm oil and soybean oil is 857.65 yuan per ton.

Soybean oil-palm oil main contract spread

Image source: Straight Flush Futures Link

On November 13th, the cost of imported palm oil was 10,584.12 yuan per ton, down 421.73 yuan from the previous day. The profit of imported palm oil was 624.12 yuan per ton, which was 18.27 yuan lower than that of the previous day.

According to the data of SEA on November 13th, India imported 845,700 tons of palm oil in October, an increase of 60% compared with September, which was mainly due to the holiday stocking demand and traders’ replenishment.

Report Date | November 13th, 2024

Author | Wu Yinqiu

Consulting CertificateNo. | Z0018989

First, the futures market analysis

On Tuesday, the stock market showed obvious weakness, and the Shanghai Composite Index closed down 1.39%. At the same time, the main contracts in the futures market generally showed a downward trend.

Judging from the transaction and positions, the futures contracts of the four main varieties have all-round growth in both transaction volume and positions.

Second, the spot market analysis

The performance of the industry is divided, and the 31 Shenwan first-class industries are mixed, and the differences are widening.

Weighted industries such as banking, non-bank finance, food and beverage dragged down CSI 300 and SSE 50, while computers and national defense industries put pressure on CSI 500 and CSI 1000 respectively. Medical biology has a positive contribution to CSI 500 and CSI 1000.

In terms of funds, the outflow of major index funds is obvious. The central bank put a net liquidity, and the cost of short-term capital fell.

In October, the data of loans and social integration met expectations, the medium and long-term loans of residents improved, the increment of government financing declined but remained high, and M1 rose in a super-seasonal manner, indicating the policy effect. The domestic economic recovery has accelerated, the risk of deflation has eased, and the infrastructure has improved, but the real estate remains to be seen.

Overseas, the Fed’s interest rate cut in December is expected to be high, US stocks hit a new high, geopolitical risks declined, and market risk appetite was stable.

Third, comprehensive analysis

Recently, the short-term boosting effect of policies on market expectations may be weakened. However, with the continuous improvement of economic data, the accelerated recovery of the domestic economy is still expected, and more positive data performance is expected in the future.

The focus of market attention is shifting from expectations to actual results, and the fundamental support force is gradually increasing.

At the same time, the impact of external market fluctuations and changes in risk appetite on the market tends to weaken, and it is no longer the main concern.

In the long run, fundamental risks are expected to gradually ease, and corporate profit expectations, the pace of policy easing, the real estate market repair and the implementation of debt resolution measures will continue to be the key factors determining the market direction.

SSE 50 Main Contract 2412

Image source: Guojin futures market software

CSI 500 Main Contract 2412

Image source: Guojin futures market software

CSI 1000 Main Contract 2412

Image source: Guojin futures market software

Shanghai and Shenzhen 300 Main Contract 2412

Image source: Guojin futures market software

gold

Report Date | November 13th, 2024

Author | Wang Jianchao

Consulting CertificateNo. | Z0015736

First, the disk situation

(1113) The opening price of Shanghai Gold’s main contract in December was 604.1 yuan/gram, which fluctuated in intraday trading and finally closed at 604.46 yuan/gram, with the highest price of 607.16 yuan/gram and the lowest price of 602.54 yuan/gram. The US dollar index remained strong and gold continued to be under pressure.

Second, the fundamentals

After the dust settled in the US presidential election, the huge uncertainty of the election was eliminated, and gold began a wave of adjustment. In addition, the dollar continued to rise. Recently, the situation of both gold and the dollar rising was broken, and the trend of gold and the dollar parted ways.

Today, Shanghai gold futures fluctuated within a narrow range, and the funds to do more gold outside the market are also eager to move. At present, the factor of seeing more gold is still there: the anchor of precious metals is not the real interest rate under the global quantitative easing system, but the monetary credit risk that the global quantitative easing system cannot continue to maintain, which is a concern about the proliferation of paper money issuance.

The latest speech of Fed officials said that once the US inflation data falls short of expectations, the Fed’s interest rate cut may be suspended; On the other hand, if the company’s profit rate drops, the Fed will face the employment risk of the whole society.

Tonight, the United States will release CPI data. Once the data is higher than expected, it may trigger the Federal Reserve to reconsider the need to cut interest rates in December. At present, the probability that the Fed will cut interest rates in December is already declining. Once the Fed stops cutting interest rates in December, gold will continue to be under pressure.

Third, the futures day K line

Weighted price trend of gold