Municipal People’s Social Security Bureau, Municipal Medical Insurance Bureau and Municipal Taxation Bureau: Notice on the payment of social insurance premiums for flexible employees

According to the requirements of the Notice of the Provincial Department of Human Resources and Social Security and the Provincial Taxation Bureau on Issuing the social insurance payment base for flexible employees in the first half of 2021 (Su Ren She Fa [2020] No.151) and the Notice of the municipal government on printing and distributing the medical insurance measures for employees in Lianyungang City (Lian Zheng Gui Fa [2020] No.3), since January 1, 2021, the social insurance payment policy for flexible employees in our city has been adjusted accordingly.

First, the upper and lower limits of the payment base

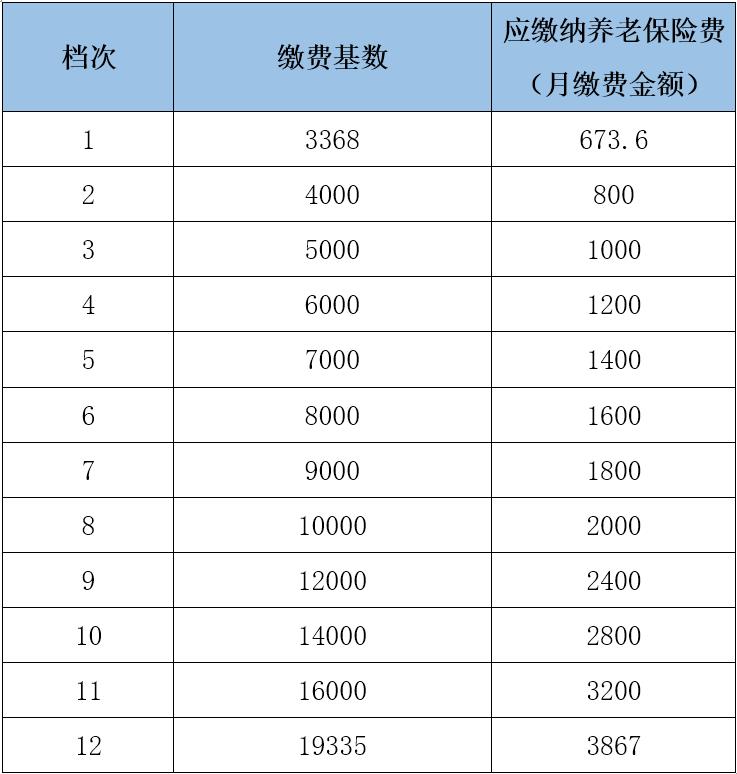

From January 1, 2021 to June 30, 2021, the upper limit of the basic old-age insurance payment for employees in the province was temporarily implemented at 19,335 yuan, and the lower limit of the payment was temporarily implemented at 3,368 yuan.

Two, the implementation of grading payment base.

From January 1, 2021 to June 30, 2021, if individual industrial and commercial households without employees and flexible employees voluntarily participate in the basic old-age insurance for enterprise employees, the base of payment salary is divided into twelve grades, which are 3,368 yuan, 4,000 yuan, 5,000 yuan, 6,000 yuan, 7,000 yuan, 8,000 yuan, 9,000 yuan, 10,000 yuan and 12,000 yuan in turn. Individual industrial and commercial households and flexible employees who have no employees can independently choose the appropriate salary base and pay the basic old-age insurance premium for enterprise employees.

If you need to adjust the current payment base, please go to the tax window of government service centers at all levels or call the local special service number consultation hotline (urban special service number 0518-96888751, Ganyu district special service number 0518-9688752, Donghai county special service number 0518-96888753, Guanyun county special service number 0518-9688754.

Payment standard for flexible employees in Jiangsu Province in the first half of 2021 (unit: yuan)

Three, the old-age insurance premium shall not be paid in advance.

From January 1, 2021, individual industrial and commercial households and flexible employees without employees may not advance the basic old-age insurance premiums for enterprise employees after the current settlement period. In order to facilitate payment, it is recommended to use bank deduction, WeChat and Alipay applet to pay monthly.

Important reminder:

From January 1st, 2021, only the monthly pension insurance premium can be paid in January, and the fees from February to December cannot be paid in advance; In February, you can only pay the old-age insurance premium from January to February, and you can’t pay the fee from March to December in advance; In March, you can only pay the old-age insurance premium from January to March, and you can’t pay the fee from April to December in advance; By analogy, in December, you can pay the endowment insurance premium from January to December of the current year in one lump sum.

Four, in 2021, you can still pay the unpaid pension insurance premiums in 2020.

Considering the influence of epidemic factors in COVID-19 in 2020, according to the Notice of the Provincial Department of People’s Social Welfare, the Provincial Department of Finance, the Provincial Bureau of Health Insurance and the Provincial Taxation Bureau on Extending the Implementation Period of the Policy of Reducing and Remitting Social Insurance Fees for Enterprises in Stages (Su Ren She Fa [2020] No.79), "Individual industrial and commercial households and all kinds of flexible employees who participate in the basic old-age insurance for enterprise employees in their personal capacity may voluntarily suspend payment if it is really difficult to pay the basic old-age insurance premiums for enterprise employees in 2020. For the unpaid month in 2020, the payment can be made before the end of 2021, and the payment period is calculated cumulatively. The payment wage base is independently selected between the upper and lower limits of the 2021 payment wage base announced by the province, and the late payment fee is exempted during the period. "

Important reminder:

The deferred payment policy is only applicable to the endowment insurance premium in 2020, and the endowment insurance premium in other years should be paid before December 31st of that year, and cannot be paid after the deadline.

Five, medical insurance payment types

From January 1st, 2021, if the whole city (divided into five overall planning areas: urban area, Ganyu District, Donghai County, Guanyun County and guannan county) participates in the basic medical insurance for employees of enterprises as flexible employees, it can choose the type of single construction overall planning or unified account combination to pay:

Single-building co-ordination is to pay according to 5.5% of the payment base, and at the same time pay large medical expenses subsidies for employees in 16 yuan and serious illness insurance for employees in 4 yuan (total 20 yuan), and only enjoy the treatment of employee medical insurance co-ordination fund, which is not included in personal account funds;

The combination of unified account and payment is based on 9% of the payment base. At the same time, 16 yuan employees’ large medical expenses subsidies and 4 yuan employees’ serious illness insurance (in total, 20 yuan) are paid, and employees’ medical insurance benefits are enjoyed according to regulations, and the funds are transferred to personal accounts with reference to on-the-job employees.

If you need to change the type to pay medical insurance, please go to the collection hall of the people’s society in each insurance co-ordination area to register the type change business before paying. Please pay attention to the payment standard when paying, and you can pay it after confirming the amount is correct.

Please note: the medical insurance premium for the first half of the year can be paid from January to June every year, and the medical insurance premium for the second half of the year to the first half of the following year can be paid in advance from July to December; Please pay the medical insurance premium in time in order to avoid the blocking of the medical insurance card.

Six, how to pay?

(1) Payment by WeChat

Pay attention to "Lianyungang Tax" WeChat WeChat official account or scan the QR code below, and click the "Social Security Payment" menu in "Micro Tax" below.

(2) Alipay payment

Alipay searches for "Jiangsu tax and social security payment" or scans the QR code below.

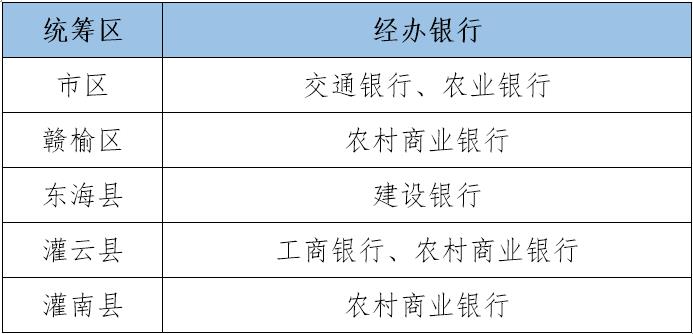

(3) Payment by bank outlets

The payer can carry valid certificates such as ID card and social security card to the handling bank outlets in the insurance co-ordination area for payment.

The city’s flexible employment payment handling bank

Lianyungang labor resources social security bureau

Lianyungang medical security bureau

Lianyungang Taxation Bureau, State Taxation Administration of The People’s Republic of China

January 8, 2021