Multi-field data are bright, and the high-quality development of China’s economy has steadily advanced.

CCTV News:Look at the economy through data and feel the vitality of China.

In the first eight months, China’s import and export of goods increased by 6% year-on-year

According to customs statistics, in the first eight months of this year, the total import and export value of China’s goods trade was 28.58 trillion yuan, a year-on-year increase of 6%. Among them, the export was 16.45 trillion yuan, up 6.9%; Imports reached 12.13 trillion yuan, up 4.7%.

Customs statistics show that in the first eight months of this year, China’s import and export to countries that jointly built the "Belt and Road" reached 13.48 trillion yuan, an increase of 7%. Among them, the import and export to ASEAN was 4.5 trillion yuan, an increase of 10%, accounting for 15.7% of China’s total import and export value in the same period. ASEAN continues to be China’s largest trading partner. In the same period, imports and exports to the European Union, the United States and South Korea increased by 1.1%, 4.4% and 8% respectively.

More than 70 initiatives to promote the high-quality development of service trade

At the policy briefing held by the State Council Information Office on September 10th, the relevant officials of the Ministry of Commerce and other departments introduced that the country will introduce more than 70 policy measures to promote the high-quality development of service trade around promoting institutional opening, promoting cross-border flow of resource elements, promoting innovation and development in key areas, expanding the international market layout, and improving the support system.

In August, the China Express Development Index increased by 12.6% year on year.

The reporter learned from the State Post Bureau that the China Express Development Index was 407 in August, up 12.6% year-on-year. Driven by summer consumption and school season, the average daily business volume of express delivery in China has increased from 440 million to 480 million.

In the first eight months, the production and sales of new energy vehicles in China increased by double digits year-on-year

According to the latest data released by China Automobile Industry Association on September 10th, in the first eight months of this year, the production and sales of new energy vehicles in China were 7.008 million and 7.037 million respectively, up by 29% and 30.9% respectively, and the sales of new energy vehicles accounted for 37.5% of all new car sales.

1-mdash this year; In August, the number of tourists from ASEAN, Japan and South Korea to China doubled.

The reporter learned from the high-level seminar on immigration management policies of ASEAN, China, Japan and South Korea being held in Suzhou that this year, 1-mdash; In August, the number of tourists from ASEAN, Japan and South Korea increased exponentially.

1-mdash this year; In August, 9.69 million people from ASEAN countries entered the mainland of China, up by 113.1% year-on-year, 680,000 Japanese citizens entered the mainland of China, up by 123% year-on-year, and 1.587 million Korean citizens entered the mainland of China, up by 142.1% year-on-year. The main reasons for entry were sightseeing, business meetings and visiting relatives. At the seminar, the National Immigration Bureau of China proposed to introduce a more active, open and efficient immigration management policy around "promoting regional personnel exchanges", promote the facilitation of border clearance, and jointly crack down on transnational organized crimes such as human trafficking, migrant smuggling, telecom fraud, online gambling and drug trafficking, so as to create a more legal and orderly entry-exit security environment.

The reporter was informed at the seminar that ASEAN and China, Japan and South Korea account for one-third of the world’s total population and economy, and countries are important trading partners of each other, with deep integration of industrial chains and supply chains and close personnel exchanges.

1— In August, more than 860 important shareholders of A-share listed companies increased their holdings.

On September 10th, CSRC announced 1—Repurchase of listed companies in August. The data shows that 1— In August, more than 10 companies bought back more than 1 billion yuan. In addition to repurchase, the number and amount of holdings of important shareholders of listed companies have also increased significantly.

The data shows that this year is 1-mdash; In August, more than 860 important shareholders of A-share listed companies increased their holdings in the secondary market, with an increase of over 55 billion yuan, both in quantity and amount. Among them, 9 companies have increased their holdings by more than 1 billion yuan. Companies with larger holdings are mainly concentrated in banking, petrochemical and other industries.

Guo Ruiming, Director of the Listing Department of the China Securities Regulatory Commission, said that the major shareholders, actual controllers and Dong Jiangao, who increased their holdings of the company’s shares, are confident in the company’s future sustainable development and optimistic about the company’s prospects. In addition, important shareholders can’t actually sell after a certain period of time, which is also very positive for stock price stability.

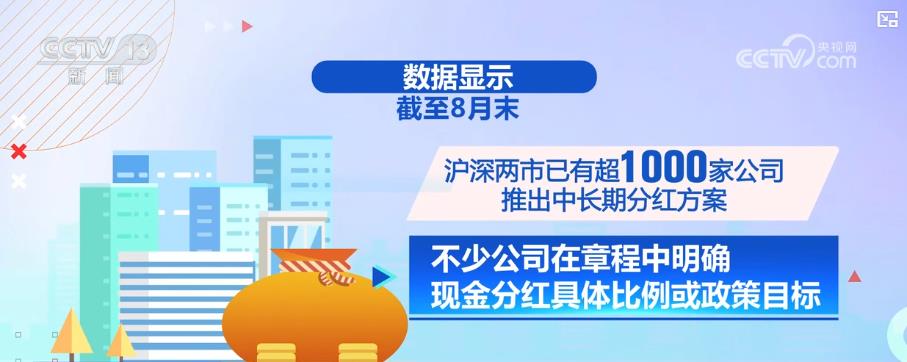

By the end of August, more than 1,000 companies in Shanghai and Shenzhen stock markets have launched medium and long-term dividend plans.

The data shows that as of the end of August, more than 1,000 companies in Shanghai and Shenzhen stock markets have launched medium-and long-term dividend plans, and many companies have clearly defined the specific proportion of cash dividends or policy objectives in their articles of association. 1-mdash this year; In August, 663 companies in Shanghai and Shenzhen stock markets announced interim dividends, a year-on-year increase of nearly three times; It is estimated that the dividend will be 533.7 billion yuan, more than doubling year-on-year, accounting for 18.5% of the net profit in the same period from 7% last year.

Guo Ruiming, director of the listing department of the China Securities Regulatory Commission, said that the regulatory authorities and exchanges guide listed companies to formulate medium and long-term dividend plans to stabilize investors’ expectations. On the other hand, the habit of promoting more capable companies to pay dividends in the medium term and paying dividends multiple times a year is gradually being cultivated, and leading companies in the industry have played a very good role in this process.