Guangdong meteorological department

Informed on the evening of August 17th.

Chaozhou city that afternoon

Recorded a tornado process

Cause trees to collapse

Individual factory buildings are damaged

↓↓↓

It is reported that the tornado appeared at the junction of Zhongshan Avenue and Fengdong Road in Pupu Village, Tiepu Town, xiangqiao district at about 15: 45 on the same day, and landed in Pupu Village for 1-2 minutes, with the whole moving path length of 100-200 meters. After preliminary identification, the tornado is EF0-EF1 intensity.

During the tornado, the automatic weather observation station in Tiepu Town measured the maximum gust of 14.4m/s (level 7) at 16: 00 that day. The tornado caused some trees in Pupu Village, Tiepu Town, Xiangqiao District to collapse, and some enterprises’ factories were damaged.

It is reported that EF0-EF1 tornadoes belong to a weak level in the tornado level, but once they appear, they may still cause some damage.

Recently, tornadoes have entered a period of high incidence!

In South China, generally speaking, Guangdong and Hainan are provinces with high incidence of tornadoes, while Guangxi is relatively rare. Tornadoes mainly occur in the flood season, which can be roughly divided into two categories. One category is tornadoes in the pre-flood season, which are produced in the background of the westerly weather system and often accompanied by thunderstorms and strong winds; The other is the tornado in the late flood season, which mainly occurs in the background of tropical cyclones.

On July 2, 2022, Typhoon Siam made landfall in Guangdong, causing at least six tornadoes, namely, in Chaoan District, Chaozhou, Guangdong, Nan ‘ao, Shantou and Shishan, Foshan on July 2, and in Huangpu, Guangzhou, Sanshui, Foshan and Huadu, Guangzhou on the morning of July 4.

On October 4th, 2015, the tornado intensity around Typhoon Rainbow reached EF3, which was the strongest tropical cyclone tornado recorded in South China. On April 13, 2019, a tornado occurred in Xuwen, Zhanjiang, with an intensity of EF3, making it the strongest westerly tornado recorded in South China.

Tornadoes in South China are mostly caused by tropical cyclones. Statistics show that in 2021, Guangdong and Hainan are the regions with the highest incidence of tropical cyclones and tornadoes in China. This is not only related to the fact that the region is most affected by tropical cyclones, but also related to the geographical environment of the region, which is high in the northwest and low in the southeast, with many flat areas and many trumpet-shaped topography (such as the Pearl River Delta Plain and Leizhou Peninsula).

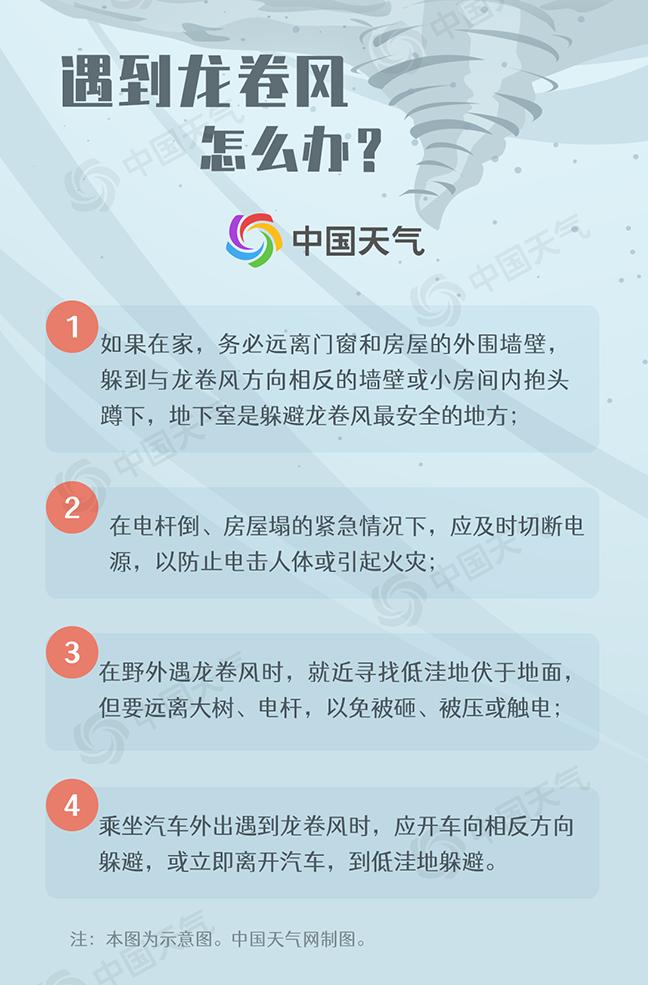

If you encounter a tornado outdoors or at home.

How to protect yourself?

Let’s get to know each other

↓↓↓

(Swipe left and right to view)

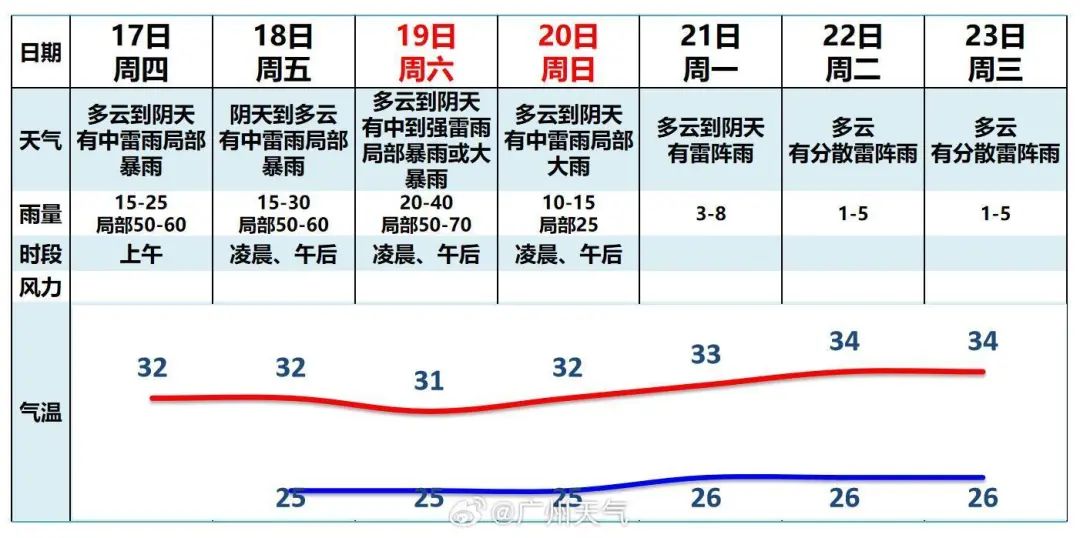

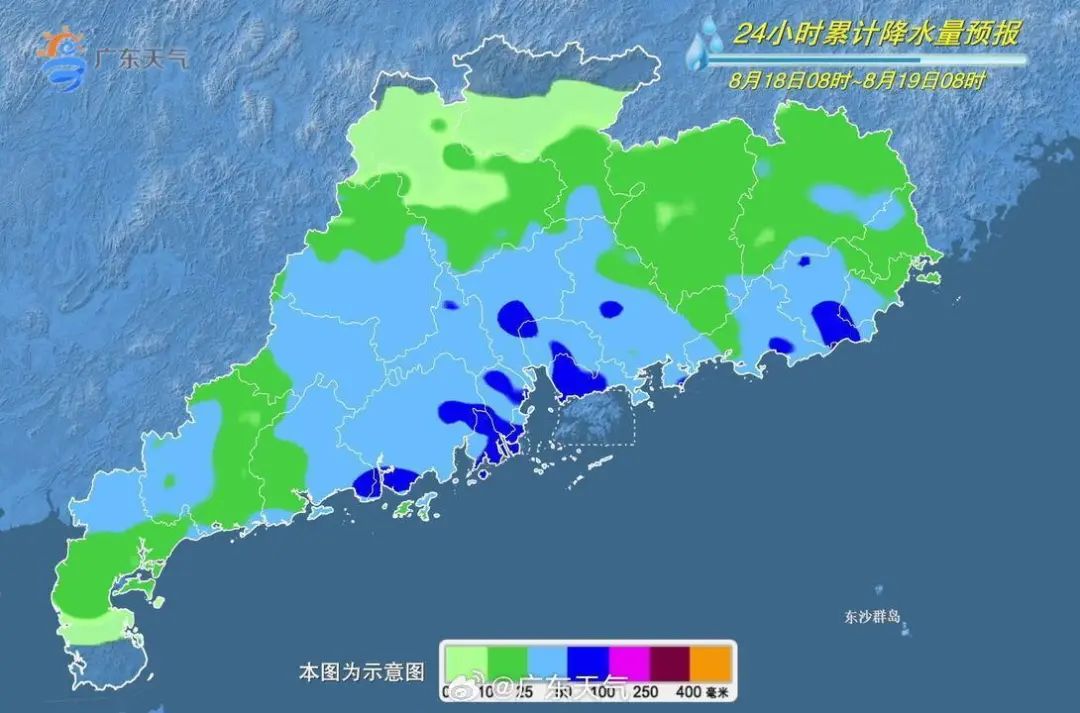

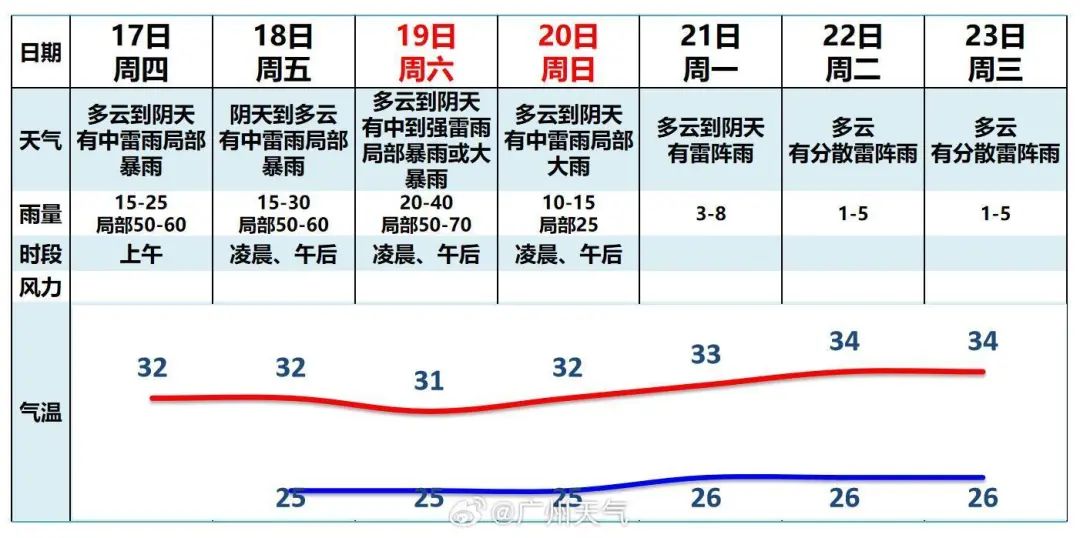

Most of Guangdong in the next 3 days

Thunderstorms are frequent.

Some cities and counties have moderate to strong thunderstorms.

The local rainfall can reach rainstorm or heavy rainstorm.

Some cities and counties during thunderstorms

Accompanied by short-term heavy precipitation

Strong convective weather such as 8~10 thunderstorms and strong winds.

The high temperature has eased.

Please pay attention to the weather changes.

Be in a safe place in time

Avoid thunderstorm and windy weather

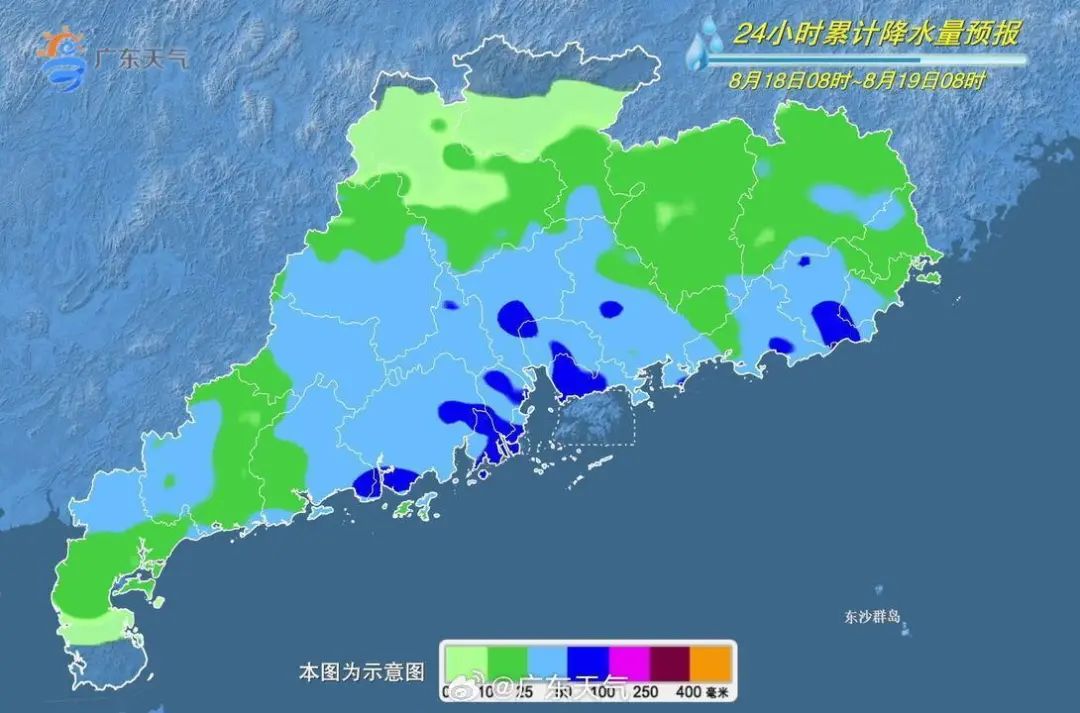

Maximum precipitation period:

Afternoon on the 18th.

In the early morning and afternoon of 19th.

There was moderate thunderstorm and local heavy rain on the 20th.

Looking forward to the 21st-23rd.

Guangdong is on the edge of subtropical high.

The weather is unstable

There are (scattered) thunderstorms.

Timely soup recommendation

Radix Astragali, Radix Codonopsis and Rhizoma Dioscoreae Thin Broth

Ingredients: Radix Astragali 50g, Radix Codonopsis 30g, dried Chinese yam 50g, and pig exhibition 500g.

Efficacy: the lung governs the hair and regulates the opening and closing of the acupoints. Insufficient lung qi can not protect the muscle surface, and the temperature difference between day and night becomes larger, which shows that it is easy to catch a cold or sweat with a little activity, such as people with allergic rhinitis. It is recommended that Astragalus membranaceus, Codonopsis pilosula and Dioscorea opposita thin broth, and Astragalus membranaceus invigorate qi and consolidate exterior; Codonopsis pilosula tonifies the middle energizer, strengthens the spleen and benefits the lung; Yam strengthens the spleen and nourishes the lungs.

Shihu Yam Lily Pig Bone Soup

Ingredients: 30g of Dendrobium, 500g of fresh yam, 30g of lily, 30g of apricot and 500g of pig bone.

Efficacy: In autumn, it is easy to have dry skin, dry nose and dry throat due to lung dryness. Dendrobium, yam and lily pig bone soup are recommended. Dendrobium and yam are tonic, nourishing yin and eliminating dampness; Lily and apricot nourish yin and moisten lung.

Pay attention to "Guangdong release"

Reply to "weather"

Can query real-time weather conditions.

News

Original title: "Finally coming out! A tornado appeared in Guangdong.

Read the original text